If you’ve got kids, it may feel like money goes out the door so fast, you really have no idea where it’s going. That’s why I was elated to find the Copilot budgeting app.

Keeping track of our family’s finances has been a (slight) obsession of mine for quite a while. I have downloaded nearly a dozen budgeting apps in the past year trying to find the right one for our family of four.

There are only a few apps on my phone that I use daily or even multiple times a day and Copilot is one of them. It keeps track of our finances exactly as I wanted. I track our expenses and plan our budget like a hawk, only because I actually find it fun.

Overview

A native app for your smartphone (and recently with an app for your Mac), Copilot is easy to get started, allows extreme budgeting flexibility and provides a picture of our family’s finances all in one place.

With two young boys who are constantly needing food, clothing, activities and apparently, sweets to survive, our budgets were all over the place. I’ve tried the Excel spreadsheet approach, the Notes app on my phone and any number of other budgeting apps but none of them delivered exactly what I was looking for.

I’m going to go out on a ledge and assume that you already know the basics around budgeting and get right into the many reasons why Copilot money should be on the homepage of your phone.

How the Freedom Unlimited card from Chase skyrocketed our point earning!

Setting Up Your Budgets on the App

Downloading and installing the Copilot budgeting app on your phone is straightforward and once you get yourself logged in, you’re ready to start connecting accounts.

I have my Freedom Unlimited card, plus two other credit cards, three bank accounts, an investment account and car payment all linked to my Copilot app. While that’s not every account I have, it is the bulk of our family’s finances all in one place.

Additionally, I’ve connected our Amazon account so purchases immediately show up and Venmo is linked as well for those expenses that you don’t use a typical credit or bank account for but don’t want to lose track of.

Linking accounts is done through Stripe so you can be sure the data transfer is secure.

Once linked, Copilot will automatically start importing data and start labeling expenses with categories it thinks are the closest related to the expense.

When I first downloaded it took me about three days of use to go back in time and change charges from years past to the appropriate category. While this isn’t required, I actually kind of enjoyed going back and categorizing everything correctly.

Why go back and do that? It gives you a historical look at your expenses and helps give you an understanding of upcoming annual or seasonal charges. Not going to lie, it was actually kind of cathartic and addicting.

Standout Budgeting Features

Out of the box the Copilot budgeting app is powerful and dynamic, giving you a true account of your finances.

Not only that, when I’m curious about past expenses – looking to see when a monthly cost increased, or how long we’ve been paying for something, the category and search features can give me an answer in seconds.

No more logging into your credit card app and trying to find the statement from the year you can’t remember.

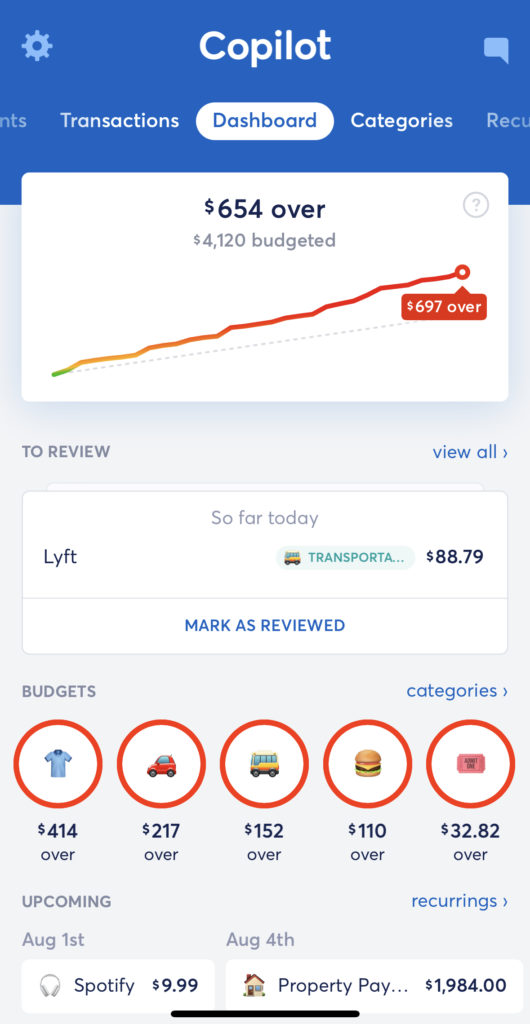

- Dashboard – As it sounds like, this is all your data in once place. The dashboard is a quick glance page that charts your spending for the month, lists transactions that need to be reviewed, showcases how you’re performing against your individual category budgets, lists upcoming recurring charges and shows your income for the month. It’s all right there to give you a high level look at how you’re doing.

- Transactions – This is where every transaction from your linked accounts will show up. Transactions are sorted by date, whether they are a regular transaction or internal transfer (moving money between accounts), whether it’s reccurring, needs to be split between categories or if you’d like to exclude it. Additionally, it’s assigned a category based on the type of transaction. The best part, this is totally customizable.

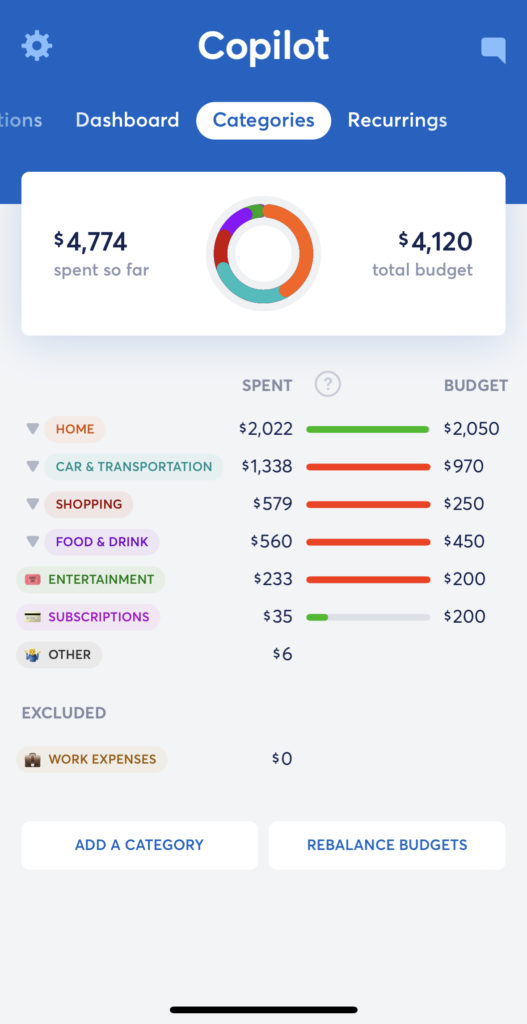

- Categories – Anything from mortgage, rent, groceries, dining, shopping, insurance, subscriptions, donations, etc. are available to be categorized. In fact, you can create as many as you’d like depending on your spending and how you like to group expenses. Each category is color coded and includes a fun emoji and bar graph to demonstrate how you’re progressing for the month. Additionally, you can create a different budget for each month or use a consistent one all year. For example, “sports/activities” is a category that we have different monthly spending in. There are recurring charges for karate but then also depending on the season, other charges for activities. So I have a different budget set for each month.

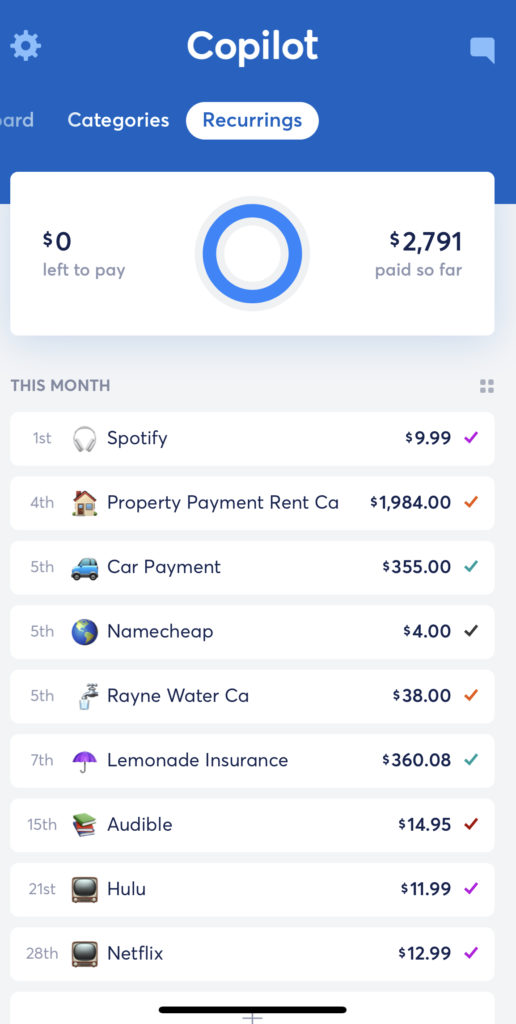

- Recurring Charges – Have those expenses that are the same each month? Car payment, utilities, streaming plans, phone company, etc. List them as a recurring expense and Copilot automatically includes that in your “spent so far” calculation so you know exactly how much “fun” money you have remaining to spend.

Why is the Copilot Budgeting App Better Than Others?

It’s like the app developers jumped into my head and pulled all the features I was looking for and put them in one place.

I’ve tried Mint, Monarch, Rocket Money and others but none of them came even close to organizing expenses how I wanted (or thought it should be). With other apps, it feels like you need to conform to their way of thinking about money management and budgeting, however, with Copilot it was the exact opposite.

They just got it.

I follow our expenses daily. I want to know what we’re spending, where and what expenses are coming in the months ahead that we need to be prepared for.

Copilot allows me to do that without even breaking a sweat. We have been better budgeters, better spenders and better prepared with our money in the 10 months or so I’ve been using Copilot than ever before. That’s just a fact.

Budget your next family trip with Copilot and jet off to Kauai

What’s Missing from the App?

Honestly, not much. However, there are a few ideas that I think would take it to the next level.

I would LOVE to see a feature where I can toggle between a family Copilot account and a personal Copilot account. I know we’re not alone in that my spouse and I have some accounts separated.

Copilot has it’s own request portal that allows users to provide suggestions to be shared with ranked voting. The team appears to be hard at work with many new feature, though mine’s not one of them at the moment. Oh, well.

Finally, What Does Copilot Cost?

The free trial is well worth it and I’m willing to say that you’ll likely be hooked in no time.

At $13/month or $95 annually, the price point may give a few folks pause, but there is no doubt in my mind that it is worth every penny. I am an annual subscriber and really couldn’t imagine tracking our money in a better way.

This is not a sponsored post, all opinions are my own. I may receive compensation from advertisements when you click on links to those products on this page.